Leasing

Chevron Renaissance lies on the site of the iconic 1950’s Chevron Hotel, one of the first global standard integrated resorts in Australia. It was one of the centrepieces of the renowned 1960’s and 1970’s heyday for the Surfers Paradise precinct when the area was known across the country as Australia’s favourite playground.

Leasing Now

Key Stats

Chevron Renaissance offers a dynamic blend of retail, dining, and entertainment within iconic Surfers Paradise.

History

Chevron Renaissance lies on the site of the iconic 1950’s Chevron Hotel, one of the first global standard integrated resorts in Australia. It was one of the centrepieces of the renowned 1960’s and 1970’s heyday for the Surfers Paradise precinct when the area was known across the country as Australia’s favourite playground.

The centre was opened in 2000 as part of the precincts rejuvenation which saw a major resort comprising three residential and holiday apartment towers built across the two-hectare site. This project revitalised Surfers Paradise and transformed the area through its world-class combined retail and accommodation offering creating one of the city’s favourite shopping and dining locations.

The Centre underwent a $5 million refurbishment in 2014, creating a renewed restaurant dining precinct in the piazza including the installation of a major shade sail structure to allow open air, yet weather protected alfresco dining.

Precision Group contracted purchased Chevron Renaissance in 2015 and embarked upon a refurbishment program to continue improvement works as part of the long term vision and commitment to the Centre.

Demographics

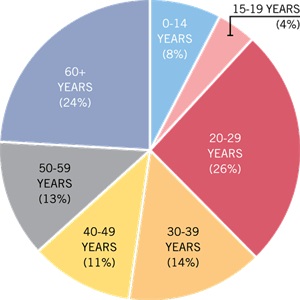

MTA age distribution

MacroPlan Dimasi has conducted quantitative market research for the Centre and the report identified three key markets for Chevron Renaissance. Each of these key markets are outlined below in more details.

Main trade area (Permanent Residents)

The Main Trade Area (MTA) is estimated at 26,412 persons as at 2021 and is expected to grow at an average rate of 2% to reach 29,160 as at 2026. The main trade area includes the densely-populated suburbs of Surfers Paradise, Paradise Waters, Chevron Island and Isle of Capri. Significant future growth is expected to be provided with medium and high density developments in Surfers Paradise.

Retail expenditure generated by the main trade area population is projected to increase from $426 million in 2021 to $578 million in 2026, reflecting an average annual growth rate of circa 4.6%.

Key characteristics of the MTA include:

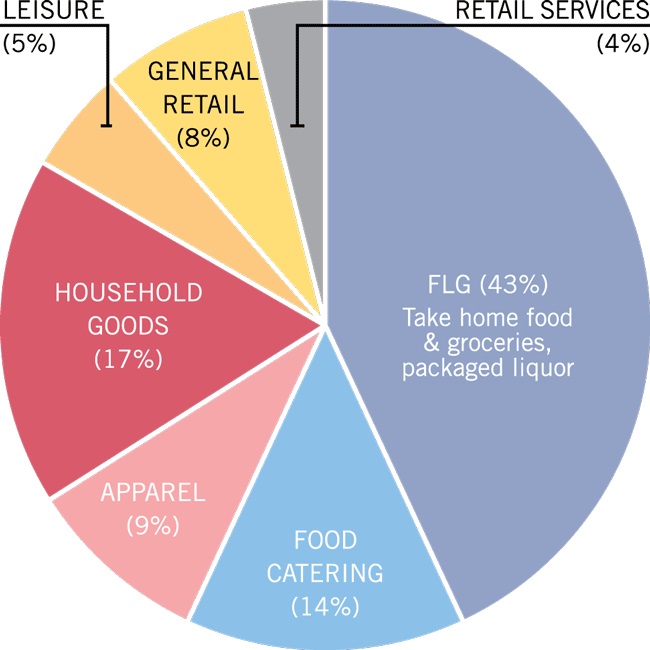

Retail expenditure by product group

- A relatively wealthy catchment (per capita income +20% on SEQ benchmark) with a low household size of 1.9, compared to the SEQ average of 2.5 persons per household. This is a reflection of the high number of lone person households (25%) and couples without children (40%).

- The proportion of persons aged 25 – 34 is 21% and is significantly higher than the SEQ benchmark. There is also a higher proportion of residents aged above 60 years and a lower proportion of residents aged 14 and under.

- 53% of residents are born overseas, which is significantly higher than the SEQ average of 29%. New Zealand, Brazil and England represent the top 3 countries of birth.

- The proportion of households renting is 51%, higher than the SEQ benchmark of 33%.

- MTA residents exhibit much higher retail expenditure profiles than SEQ averages, with per capita spending about 11% higher. Expenditure on food catering services (i.e. cafés, restaurants and take-away food) is 38% above average while spending on retail services is 39% above the SEQ average.

- Fresh food and packaged liquor spending accounts for the highest proportion of total retail expenditure at around 43% of total capacity.

*Source: Australian Bureau of Statistics Census- 2021

The worker market

Surfers Paradise provides more than 70,000m2 of office floor space, estimated to include approximately 6,120 workers, within a walkable 500 metres from Chevron Renaissance. This market is expected to increase by 150-225 workers per year, reaching 8,295 by 2026. These workers generate an estimated $81 million per year in retail expenditure and this is expected to increase by about 5.5% per annum, reaching $153.9 million by 2026.

Workers in CBD locations typically spend 25-40% of their total annual retail expenditure near their place of work, typically on convenience retail and food catering.

The socio-demographic profile and retail expenditure of the worker trade area is similar to the MTA residents. It is expected that workers contribute moderately towards the annual sales turnover of Chevron Renaissance, in the order of 5% per annum.

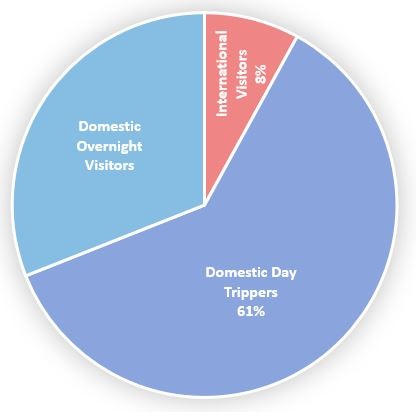

Tourist market - Domestic & International

The tourist market is significant for Chevron Renaissance and is estimated to provide an annual equivalent population of about 16-17,000 persons, providing approximately 30% of the Centre’s annual sales. Visitors to Surfers Paradise spend an estimated $544 million per year on retail goods and services, while visitors to the Gold Coast spend around $2.1 billion per year. The domestic tourism market generates about $389 million in retail expenditure and the international domestic market adds an estimated $155 million per year.

There are more than 50 hotels and serviced apartments within a 1km radius of the Centre. Visitors from Japan and New Zealand have historically been the largest for Surfers paradise comprising 20-25% of the total visitor numbers each. However, following recent natural disasters these markets have declined significantly. The Chinese market has grown steadily to about 8% of total international visitors. The combined Asian market represents 47% of the total tourist market, Europe accounts for 23%, while America and other countries account for 9-10%.

Growth in this market is forecast at 3.3% per annum for international tourist visitation and 0.3% for domestic visitors.

Surfers Paradise Tourism Visitation

Surfers Paradise Developments

Developments within 1.6kms of Chevron Renaissance Shopping Centre:

7 sites with 763 apartments – under construction or recently completed19 sites with 5,046 apartments – approved for development

8 sites with 1,991 apartments – proposed for development

View the full map and list of Surfers Paradise Developments here.